Ventezo Journal

| Journal status: live Ventezo joined in | not yet |

Ventezo Profile

Website

Year

2018

Country

SVG

Branches

1

Regulation

not regulated

Registration

FSA SVG

Investor protection

Fund protection

no

Publicly traded

no

Restricted in

Not serving

х Albania, Barbados, Botswana, Burkina Faso, Cambodia, Canada, Cayman Islands, Ghana, Jamaica, Mauritius, Morocco, Myanmar, Nicaragua, North Korea, Pakistan, Panama, Senegal, Syria, US, Uganda, Yemen, Zimbabwe

Broker type

STP, DMA, ECN-pricing

Dealing book

A-book

Tier

3

Execution speed

29 ms

LPs total

14

LPs quality

Tier-1 Banks

LPs names

BNP Paribas, Bank of America, Barclays, Deutsche Bank, JPMorgan, Morgan Stanley, Nomura, UBS

Ventezo Accounts

STP

DMA

Minimum Deposit

50 $

200 $

Leverage

1000 : 1

500 : 1

Minimum Lot

0.01 lots

0.01 lots

EURUSD spread

1 pips

0 pips

Commission

0 $/lotRT

5 $/lotRT

Volume

100 lots

100 lots

Margin Call

75 %

75 %

Stop Out

30 %

30 %

Execution

Market

Market

Spread

floating

floating

Scalping

yes

yes

Deposit & Fees

Deposit methods

Bank Wire, Credit Card, Debit Card, Skrill, Neteller, Perfect Money, FasaPay, Bitcoin, Ethereum, Litecoin, Tether

Base currency

USD

Segregated accounts

yes

Interest on margin

no

Inactivity fee

none

| Update broker |

- Full listing profile: Ventezo broker profile

Is Ventezo safe?

- Investor protection: no

- Regulation: not regulated

- Registration: FSA SVG

- Publicly traded: no

- Segregated account: yes

- Guaranteed Stop Loss: no

- Negative Balance Protection: yes

Is Ventezo trusted?

- Information transparency: high

★★★★★ - Customer service: prompt, helpful

★★★★★ - Ventezo website: semi-detailed, updated

★★★ - Ventezo popularity (by visitor count): least visited

★

How Ventezo works

3.4. It is understood that Ventezo does not execute client orders in Financial Instruments on an own account basis, as principal to principal against the client. Ventezo uses a third party as Execution Venue. Ventezo transmits Client Orders or arranges for their execution with a third party (ies) known as Straight Through Process (STP and is explained in the “Best Interest and Order Execution Policy” found on the website (https://www.ventezo.com/). In the event of lack of liquidity of the Liquidity Provider after a successful Order for the Client, Ventezo will not be in a position to settle the transaction for the Client (i.e. pay the Client the Difference of his successful trade).

11. Conflicts of Interest

11.1. When Ventezo deals with the Client, Ventezo, an associate, a relevant person or some other person connected with Ventezo may have an interest, relationship or arrangement that is material in relation to the Transaction/Order concerned or that it conflicts with the Client’s interest.

https://ventezo.com/docs/Risk-Disclosure-And-Warnings-Notice.html

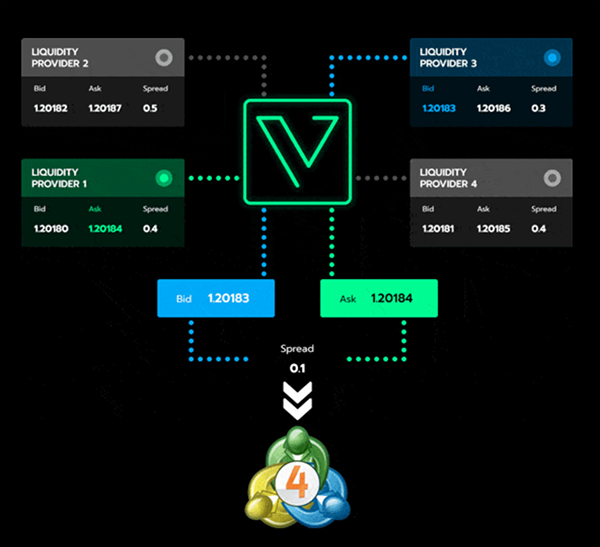

We steadily transfer 100% of orders to liquidity aggregators - the world's largest banks. For their part liquidity aggregators provide us with stable high prices and minimal rejection rate (less than 1%).

With Ventezo's DMA model, institutional traders can trade anonymously and use aggregated streaming quotes from the best market makers. We securely protect DMA trade flows from position and other high-frequency traders. Because of this, institutional traders value the Ventezo platform more than other anonymous multi-bank outlets, including ECNs.

With Ventezo's DMA model, institutional traders can trade anonymously and use aggregated streaming quotes from the best market makers. We securely protect DMA trade flows from position and other high-frequency traders. Because of this, institutional traders value the Ventezo platform more than other anonymous multi-bank outlets, including ECNs.

https://www.ventezo.com/liquidity-aggregation

Our ECN Business Model

Ventezo customers get maximum liquidity, the lowest spreads and the lowest trading fees.

Institutional Grade Pricing

We strive to ensure that retail clients receive the same service and liquidity as institutional clients. That's why there are no differences for clients on the Ventezo platform. Whether you're a novice or experienced trader, you'll get spreads starting at 0.0 pips and maximum speed for order execution.

Ventezo customers get maximum liquidity, the lowest spreads and the lowest trading fees.

Institutional Grade Pricing

We strive to ensure that retail clients receive the same service and liquidity as institutional clients. That's why there are no differences for clients on the Ventezo platform. Whether you're a novice or experienced trader, you'll get spreads starting at 0.0 pips and maximum speed for order execution.

https://www.ventezo.com/about

Do you guarantee stop orders?

Being an ECN broker, Ventezo cannot guarantee filling at the requested rate. After being triggered, a pending order becomes a market one and is filled at the best available price, which primarily depends on the market conditions, available liquidity, trading pattern and volume.

Do you allow hedging/scalping/news trading?

Ventezo allows scalping, hedging and other strategies, if the orders are placed in accordance with our Customer Agreement. However please note that arbitrage trading is not allowed.

Being an ECN broker, Ventezo cannot guarantee filling at the requested rate. After being triggered, a pending order becomes a market one and is filled at the best available price, which primarily depends on the market conditions, available liquidity, trading pattern and volume.

Do you allow hedging/scalping/news trading?

Ventezo allows scalping, hedging and other strategies, if the orders are placed in accordance with our Customer Agreement. However please note that arbitrage trading is not allowed.

https://www.ventezo.com/faq

Add new comment...