XGLOBAL Journal

| Journal status: live XGLOBAL joined in | not yet |

XGLOBAL Profile

Website

Year

2012

Country

Cyprus

Branches

1

Regulation

CySEC Cyprus

Registration

CySEC Cyprus, VFSC Vanuatu, BaFin Germany, FCA UK, CONSOB Italy

Investor protection

Fund protection

Cyprus Investor Compensation Fund (ICF)

Publicly traded

no

Restricted in

Not serving

х Iran, North Korea, Syria, US

Broker type

STP, DMA, ECN pricing

Dealing book

A-book

Tier

3

Execution speed

200 ms

LPs total

4

LPs quality

Tier-1 Banks, Other

LPs names

Credit Financier Invest (CFI), GAIN Capital, Hantec Markets, Swissquote, X Global Markets

XGLOBAL Accounts

STP

ECN

Minimum Deposit

100 $

100 $

Leverage

30 : 1

30 : 1

Minimum Lot

0.01 lots

0.01 lots

EURUSD spread

1 pips

0.2 pips

Commission

0 $/lotRT

7.5 $/lotRT

Volume

200 lots

200 lots

Margin Call

100 %

100 %

Stop Out

50 %

50 %

Execution

Market

Market

Spread

floating

floating

Scalping

yes

yes

Deposit & Fees

Deposit methods

Bank Wire, Credit Card, Debit Card, Skrill, Neteller

Base currency

USD, EUR, GBP, CHF, NOK

Segregated accounts

yes

Interest on margin

no

Inactivity fee

after 6 months

| Update broker |

- Full listing profile: XGLOBAL broker profile

Is XGLOBAL safe?

- Investor protection: Cyprus Investor Compensation Fund (ICF)

- Regulation: CySEC Cyprus

- Registration: CySEC Cyprus, VFSC Vanuatu, BaFin Germany, FCA UK, CONSOB Italy

- Publicly traded: no

- Segregated account: yes

- Guaranteed Stop Loss: no

- Negative Balance Protection: yes

Is XGLOBAL trusted?

- Information transparency: high

★★★★★ - Customer service: prompt, helpful

★★★★★ - XGLOBAL website: highly detailed, updated

★★★★★ - XGLOBAL popularity (by visitor count): low visits

★★

How XGLOBAL works

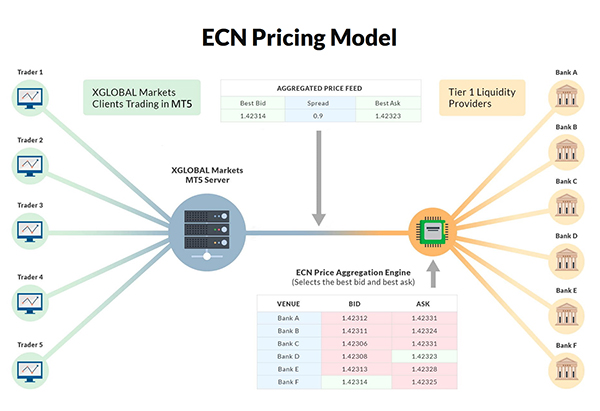

We stream a low latency ECN price feed that is ultimately sourced from the best bid and ask prices available at interbank market participants. Depending on account type we charge either volume based commissions or a competitive spread to the feed to ensure client positions can comfortably be covered with third party liquidity providers if we are not able to internally match them.

https://www.xglobalmarkets.com/trading/ecn-stp-execution-model/

4.11. With respect to each class of

derivative financial instruments and

specifically CFDs (access to the

trading of which is provided by the

Company), the Company transmits

client orders for execution to third

party entities. For client orders in

relation to the financial instruments

offered by the Company, the

Company acts as Principal and not as

Agent on the Client’s behalf at all

times. Despite the fact that the

Company electronically transmits

client orders for execution to third

party liquidity providers and/or other

entities, contractually it is the sole

counterparty to all client trades and

any execution of orders is done in the

Company’s name; therefore, the

Company is the sole Execution Venue

for the execution of client orders.

5. Order Execution Elements

5.1. Prices: The Company generates its

own tradable prices based on price

feeds from some of the world’s

leading liquidity providers and

independent price providers.

Among others, the

Company uses the following

Execution Venues:

- X Global Markets Ltd

- Hantec Markets Limited

- Credit Financier Invest (CFI) Ltd

http://media.xglobalmarkets.com/docs/xg-best-execution-policy-for-trading-cfds.pdf

Restrictions: We do not support latency arbitrage or high frequency trading

https://www.xglobalmarkets.com/accounts/account-specifications/

Do you allow scalping?

Yes, we do.

Yes, we do.

https://www.xglobalmarkets.com/faq/

Add new comment...