The LiMarkets Journal

| Journal status: live The LiMarkets joined in | not yet |

The LiMarkets Profile

Website

Year

2019

Country

SVG

Branches

1

Regulation

not regulated

Registration

FSA SVG

Investor protection

Fund protection

no

Publicly traded

no

Restricted in

Not serving

х US

Broker type

MM, STP, DMA, ECN marketing

Dealing book

A+B hybrid book, A-book

Tier

3

Execution speed

...

LPs total

50

LPs quality

Tier-1 Banks, Other

LPs names

...

The LiMarkets Accounts

MM

ECN

Minimum Deposit

100 $

100 $

Leverage

500 : 1

500 : 1

Minimum Lot

0.01 lots

0.01 lots

EURUSD spread

1.6 pips

0 pips

Commission

0 $/lotRT

4 $/lotRT

Volume

...

...

Margin Call

100 %

100 %

Stop Out

...

...

Execution

Market

Market

Spread

floating

floating

Scalping

yes

Unlimited

Deposit & Fees

Deposit methods

Bank Wire, Credit Card, Debit Card, Skrill, Neteller, Bitcoin

Base currency

USD, EUR, GBP

Segregated accounts

yes

Interest on margin

no

Inactivity fee

after 3 months

| Update broker |

- Full listing profile: The LiMarkets broker profile

Is The LiMarkets safe?

- Investor protection: no

- Regulation: not regulated

- Registration: FSA SVG

- Publicly traded: no

- Segregated account: yes

- Guaranteed Stop Loss: no

- Negative Balance Protection: yes

Is The LiMarkets trusted?

- Information transparency: sufficient

★★★ - Customer service: virtually non-existent

★ - The LiMarkets website: semi-detailed, updated

★★★ - The LiMarkets popularity (by visitor count): low visits

★★

How The LiMarketsworks

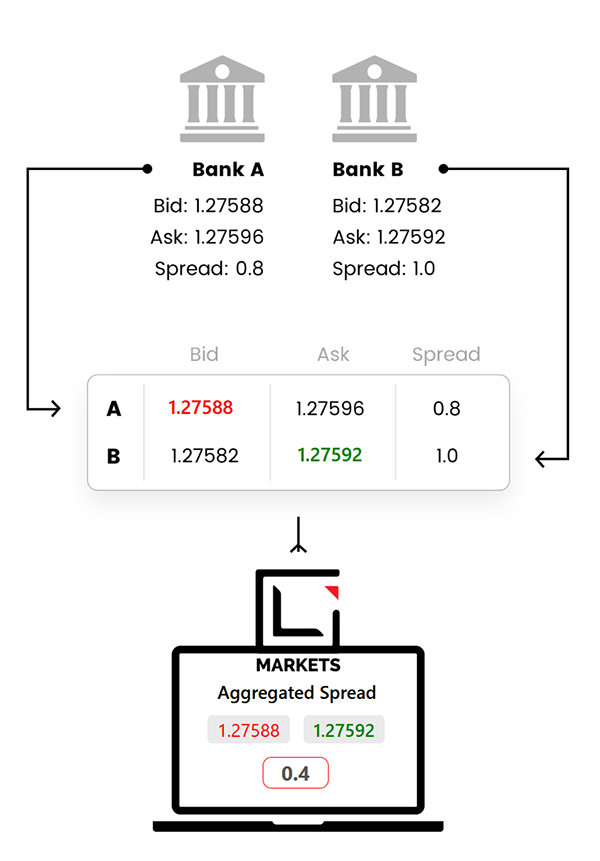

By providing true ECN connectivity to customers, LiMarkets is able to offer market-leading pricing and trading conditions through the MT5 platform. With liquidity from over 50 different banks and dark pool liquidity sources The LiMarkets ECN account was built for day traders, scalpers and expert advisors.

https://www.thelimarkets.com/aboutus/lightning-fast-ecn-broker.php

We at the LiMarkets provide negative balance protection assurance to avoid any sort of balance volatility.

https://thelimarkets.com/aboutus/who-are-we.php

“Liquidity provider” shall mean a financial institute which has sufficient floating capital and

works as a counterpart for company clients in the execution of financial instruments by the means

of electronic communication network (ECN).

https://thelimarkets.com/pdf/general-business-terms.pdf

1.2 It is understood that in relation to individual transactions, depending on the type of Client Account

held by each Client, the Company will either be executing Orders as a counterparty in the particular

transaction in which case the Company will be the execution venue or it will be transmitting the

Orders for execution to a third party (known as Straight Through Processing, STP), in which case the

Company will not be acting as a counterparty in the transaction and the execution venue will be the

third party

6.10 The commission rates for performing trading operations in Market maker Accounts are shown on the Company’s official website in the Contract Specifications section.

6.11 The Company is entitled, in relation to Interbank Accounts: A. To adjust the best available prices in the market by the amount of its own commission.

6.10 The commission rates for performing trading operations in Market maker Accounts are shown on the Company’s official website in the Contract Specifications section.

6.11 The Company is entitled, in relation to Interbank Accounts: A. To adjust the best available prices in the market by the amount of its own commission.

https://thelimarkets.com/pdf/client-agreement.pdf

Add new comment...