LMAX Journal

| Journal status: live LMAX joined in | not yet |

LMAX Profile

Website

Year

2009

Country

UK

Branches

1

Regulation

FCA UK

Registration

FCA UK, CySEC Cyprus

Investor protection

Fund protection

UK Financial Services Compensation Scheme (FSCS)

Publicly traded

no

Restricted in

Not serving

х Australia, Canada, Singapore, US

Broker type

ECN

Dealing book

A-book

Tier

3

Execution speed

85 ms

LPs total

...

LPs quality

...

LPs names

...

LMAX Accounts

ECN

Minimum Deposit

10000 $

Leverage

100 : 1

Minimum Lot

0.1 lots

EURUSD spread

0 pips

Commission

5 $/lotRT

Volume

250 lots

Margin Call

100 %

Stop Out

70 %

Execution

Market

Spread

floating

Scalping

yes

Deposit & Fees

Deposit methods

Bank Wire

Base currency

USD

Segregated accounts

yes

Interest on margin

no

Inactivity fee

after ... months

| Update broker |

- Full listing profile: LMAX broker profile

Is LMAX safe?

- Investor protection: UK Financial Services Compensation Scheme (FSCS)

- Regulation: FCA UK

- Registration: FCA UK, CySEC Cyprus

- Publicly traded: no

- Segregated account: yes

- Guaranteed Stop Loss: no

- Negative Balance Protection: yes

Is LMAX trusted?

- Information transparency: high

★★★★★ - Customer service: prompt, helpful

★★★★★ - LMAX website: semi-detailed, updated

★★★ - LMAX popularity (by visitor count): average

★★★

How LMAX works

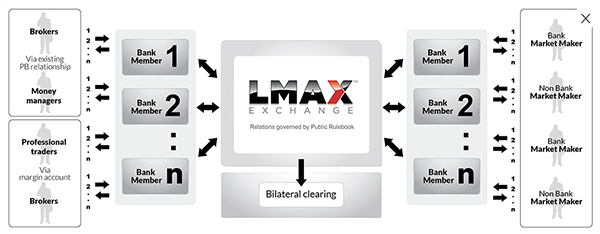

LMAX Global is an FCA regulated Broker for FX and part of the LMAX Exchange Group. LMAX Global offers brokers and professional traders the ability to trade on the LMAX Exchange central limit order book, offering tighter spreads on streaming firm liquidity from top tier banks and proprietary trading firms.

LMAX Global offers liquidity and exchange quality execution from LMAX Exchange suited for clients in the following categories:

- Broker dealers

- Money managers

- MT4/5 brokers

- Professional traders

In the event that one of our banks should become insolvent... a client that meets the eligible claimant criteria of the Financial Services Compensation Scheme (“FSCS”) will benefit from the protection of the first £75,000 of that client’s deposited money. In the event that LMAX should become insolvent a client that meets the eligible client criteria in relation to investment business conducted with LMAX may benefit from the protection of the FSCS in relation to the first £50,000 of a claim.

https://www.lmax.com/documents/LMAXGlobal-client-money-overview-for-customers.pdf

Add new comment...