Hugos Way Journal

| Journal status: live Hugos Way joined in | not yet |

Hugos Way Profile

Website

Year

2019

Country

SVG

Branches

1

Regulation

not regulated

Registration

FSA SVG

Investor protection

Fund protection

no

Publicly traded

no

Restricted in

Not serving

х Bahamas, Botswana, Burma, Cambodia, Congo, Congo, Cuba, Ethiopia, Ghana, Iran, Iraq, Japan, Kenya, Lebanon, Libya, Malta, North Korea, Pakistan, Panama, Somalia, Sri Lanka, Sudan, Syria, Trinidad and Tobago, Tunisia, UK, Vietnam, Yemen, Zimbabwe

Broker type

STP, ECN marketing

Dealing book

A-book

Tier

3

Execution speed

300 ms

LPs total

50

LPs quality

Tier-1 Banks, Other

LPs names

not disclosed

Hugos Way Accounts

ECN

Minimum Deposit

10 $

Leverage

500 : 1

Minimum Lot

0.01 lots

EURUSD spread

0.8 pips

Commission

0 $/lotRT

Volume

1000 lots

Margin Call

100 %

Stop Out

70 %

Execution

Market

Spread

floating

Scalping

yes

Deposit & Fees

Deposit methods

Bank Wire, Credit Card, Debit Card, Bitcoin, VLoad

Base currency

USD

Segregated accounts

yes

Interest on margin

no

Inactivity fee

after 6 months

| Update broker |

- Full listing profile: Hugos Way broker profile

Is Hugos Way safe?

- Investor protection: no

- Regulation: not regulated

- Registration: FSA SVG

- Publicly traded: no

- Segregated account: yes

- Guaranteed Stop Loss: no

- Negative Balance Protection: no

Is Hugos Way trusted?

- Information transparency: sufficient

★★★ - Customer service: prompt, helpful

★★★★★ - Hugos Way website: highly detailed, updated

★★★★★ - Hugos Way popularity (by visitor count): top visited

★★★★★

How Hugo’s Way works

Trade with a True STP Broker

Hugo’s Way offers a new level of trading and is able to offer market-leading pricing and trading conditions through the MT4 platform by providing clients with true ECN connectivity

https://hugosway.com/

Hugo’s Way is able to offer market-leading pricing and trading conditions through the MT4 platform by providing clients with true ECN connectivity.

With liquidity from over 50 different banks and dark pool liquidity sources Hugo’s Way ECN account was built for day traders, scalpers and expert advisors.

With liquidity from over 50 different banks and dark pool liquidity sources Hugo’s Way ECN account was built for day traders, scalpers and expert advisors.

https://hugosway.com/lighting-fast-ecn-broker/

STP Execution

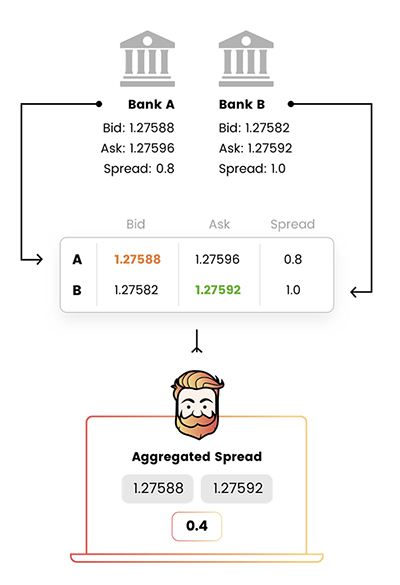

Hugo’s Way practices the STP (Straight Through Processing) execution, model. What this means is that whenever a Hugo’s Way client executes a trade, there will be no dealing desk manipulation, nor any re-quotes, ever. This also eliminates the possibility of any conflicts of interest. Each and every trade is processed via the Hugo’s Way aggregator, which guarantees the very best rates on your trades, as these are pulled from a pool of top-tier liquidity financial institutions.

Hugo’s Way practices the STP (Straight Through Processing) execution, model. What this means is that whenever a Hugo’s Way client executes a trade, there will be no dealing desk manipulation, nor any re-quotes, ever. This also eliminates the possibility of any conflicts of interest. Each and every trade is processed via the Hugo’s Way aggregator, which guarantees the very best rates on your trades, as these are pulled from a pool of top-tier liquidity financial institutions.

https://hugosway.com/about-us/

4.7 CROSS TRADE CONSENT

Customer hereby acknowledges and agrees that Hugo’s Way may act as the counterparty to Customer for any trade entered for the undersigned’s Account.

Prices from Hugo’s Way are independent of prices found elsewhere. Customers acknowledge that the prices reported by Hugo’s Way for buying and selling are independent and can differ from the prices displayed elsewhere or from other liquidity providers in the interbank changes in liquidity from interbank to Hugo’s Way, an unbalanced position or exposure at Hugo’s Way, or differing expectations of price movements. Hugo’s Way expects that in most cases the prices provided to its Customers will be in line with the general interbank market but does not warrant or imply that this will always be the case.

Although there may be instances when the aggregate OTC market enters a “Fast Market” situation or periods where liquidity is in short or no supply, it is important to note that prices, bid/ask spreads and liquidity will reflect the prevailing interbank market liquidity for Hugo’s Way.

When liquidity decreases, Customers can expect, at the minimum, to have wider bid to ask spreads as the supply of available bid/ask prices, outstrips the demand.

Hugo’s Way cannot and does not guarantee its prices in times of extraordinary market volatility.

There is No Guarantee that Hugo’s Way will be able to execute stop-loss orders, limit orders or OCO Orders at the Customer Entered Price. Customer acknowledges and agrees that there may be market, liquidity or other conditions that will prevent Hugo’s Way from executing Customers specific Stop Loss Orders, Limit Orders or OCO Orders at the Customer designated price. In some cases, the orders will be executed at prices that are less favourable to the price entered and desired by the Customer. The Customer acknowledges and agrees that they are still responsible for trades executed at levels different from their orders and that Hugo’s Way is not liable for failure to do so.

Customer hereby acknowledges and agrees that Hugo’s Way may act as the counterparty to Customer for any trade entered for the undersigned’s Account.

Prices from Hugo’s Way are independent of prices found elsewhere. Customers acknowledge that the prices reported by Hugo’s Way for buying and selling are independent and can differ from the prices displayed elsewhere or from other liquidity providers in the interbank changes in liquidity from interbank to Hugo’s Way, an unbalanced position or exposure at Hugo’s Way, or differing expectations of price movements. Hugo’s Way expects that in most cases the prices provided to its Customers will be in line with the general interbank market but does not warrant or imply that this will always be the case.

Although there may be instances when the aggregate OTC market enters a “Fast Market” situation or periods where liquidity is in short or no supply, it is important to note that prices, bid/ask spreads and liquidity will reflect the prevailing interbank market liquidity for Hugo’s Way.

When liquidity decreases, Customers can expect, at the minimum, to have wider bid to ask spreads as the supply of available bid/ask prices, outstrips the demand.

Hugo’s Way cannot and does not guarantee its prices in times of extraordinary market volatility.

There is No Guarantee that Hugo’s Way will be able to execute stop-loss orders, limit orders or OCO Orders at the Customer Entered Price. Customer acknowledges and agrees that there may be market, liquidity or other conditions that will prevent Hugo’s Way from executing Customers specific Stop Loss Orders, Limit Orders or OCO Orders at the Customer designated price. In some cases, the orders will be executed at prices that are less favourable to the price entered and desired by the Customer. The Customer acknowledges and agrees that they are still responsible for trades executed at levels different from their orders and that Hugo’s Way is not liable for failure to do so.

https://hugosway.com/terms-conditions/

Add new comment...