Darwinex Journal

| Journal status: live Darwinex joined in | not yet |

| Update broker |

- Full listing profile: Darwinex broker profile

Is Darwinex safe?

- Investor protection: UK Financial Services Compensation Scheme (FSCS)

- Regulation: FCA UK

- Registration: FCA UK

- Publicly traded: no

- Segregated account: yes

- Guaranteed Stop Loss: no

- Negative Balance Protection: yes

Is Darwinex trusted?

- Information transparency: high

★★★★★ - Customer service: prompt, helpful

★★★★★ - Darwinex website: semi-detailed, updated

★★★ - Darwinex popularity (by visitor count): top visited

★★★★★

How Darwinex works

Liquidity Aggregation

Our priority lies in optimizing execution speed without compromising liquidity. We provide prices from two complimentary sources, exploiting their advantages depending on market conditions. We have a provider without "last look" offering the best speed to access the market and a provider that offers us liquidity during high-volatility conditions. Our proprietary aggregation engine evaluates market conditions and directs the flow to the best provider at any point in time.

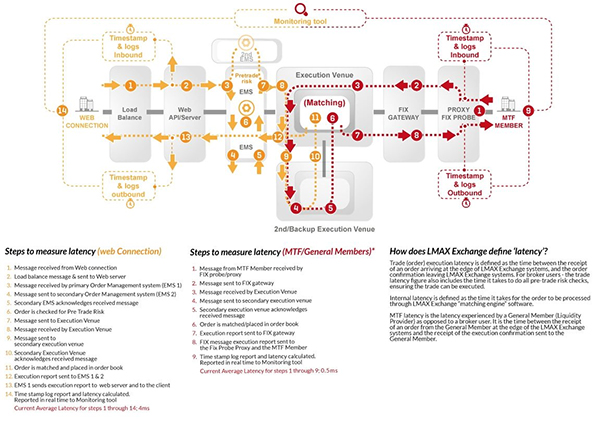

We execute each Order you place with us by placing an order identical in all respects apart, from settlement (a Back to Back Order) on LMAX Exchange or in other Liquidity Pools (the “Execution Venues”).

2.2 Liquidity Pools

We may execute a Back to Back Order on other Liquidity Pools, via our Prime Brokerage providers. In doing so, where possible we will reference other available market prices and demonstrate that we have satisfied our best execution obligations to you.

3.1 Execution of orders

We execute each Order you place with us by placing an order identical in all respects apart from settlement in certain cases (a “Back to Back Order”) on the Execution Venues. Note that the Instruments we offer you are cash settled. We place Orders as principal and not as an agent on your behalf; we are the sole counterparty to your trades. When our Back to Back Order is matched, we will open or close a trade on your Account at the same price and size.

3.2 Prices

The prices on which you trade with us will generally be the prices available to us on the Execution Venues, although we reserve the right to add an additional spread at times.

10 Negative Balance Protection Obligation

10.1 With effect from August 2018, the Company has become obliged to take steps to protect the Client's Trading Account from acquiring at any time a value of less than zero as a consequence of the Client's trading CFDs with the Company.

The Company understands that it is required to provide from its own resources in relation to the protection of the Client's Trading Account from registering a negative balance, and that the Company cannot look to the Client to contribute extra capital as a means of repaying any negative balance or value.

4.3 Quantity available to trade - medium importance

We have restrictions in place in terms of the minimum and maximum size of position you may hold in an Instrument at any one time. Any opening Order you place with us will be subject to these restrictions.

Our priority lies in optimizing execution speed without compromising liquidity. We provide prices from two complimentary sources, exploiting their advantages depending on market conditions. We have a provider without "last look" offering the best speed to access the market and a provider that offers us liquidity during high-volatility conditions. Our proprietary aggregation engine evaluates market conditions and directs the flow to the best provider at any point in time.

Add new comment...