⭐ What is the difference between DMA and ECN Brokers?

FOREX.com

There are many similarities between the two models in terms of pricing. Both provide clients with access to the interbank market which creates tight pricing with depth of book transparency. In a typical anonymous ECN model, the individual client must have secured their own credit line from a traditional Prime Broker or Prime of Prime provider in order to participate in the ECN.

— FOREX.com, https://www.forex.com/en-ca/

FXOpen

True ECN Model The ECN model gives traders access to the Interbank market where the counterparty to your trade is a liquidity provider such as a bank, fund, or another trader. There is no intervention from FXOpen, no dealing desk and no requotes.

ECN accounts are suitable for all types of trading due to its fast execution and deep liquidity. This is especially useful for scalping, high frequency and automated trading. The ECN Model uses Market Execution, which means that your order will be filled in the interbank market but the execution price may differ from the price you requested upon placing the order.

All participants of the ECN have equal rights when it comes to order execution regardless of their capital. Additionally everyone on the ECN can act as both liquidity providers and liquidity receivers. This ensures that all transactions take place in a completely fair and transparent environment.

— FXOpen, https://www.fxopen.com/en-ca/why-us/

Fair Forex

TRUE ECN BROKER SERVICES

Electronic Communication Network, otherwise known as ECN, streamlines the way people conduct business in foreign exchange. It builds a direct bridge between brokers and liquidity providers on behalf of retail traders.

Our brokers at Fair Forex take this one step further through TRUE ECN. Some ECN brokers take your trades to different banks and hedge funds rather than to the entire network. As a result, they might not secure the best deals on the market.

Our TRUE ECN brokers unlock the door to a greater network so we can give you the best available price in the entire market.

— Fair Forex, https://fairforex.com/ecn/

Kitco Markets

An electronic communication network (ECN) is a computerised system that automatically matches buy and sell orders for securities in the market. It connects major brokerages and individual traders so they can trade directly between themselves without going through a middleman and make it possible for investors in different geographic locations to quickly and easily trade with each other. Auto trade ECN is an extremely efficient process using sophisticated technology.

There are various advantages associated with auto ECN trading and direct connection with liquidity providers:

- Higher bid and lower ask prices

- Tighter spreads

- Direct trading and better liquidity

- Immediate trade executions

- Brokers cannot trade against their clients

— Kitco Markets, https://kitcomarkets.com/auto-trade-ecn-pricing/

OBOFX

ECN can best be described as a bridge linking smaller market participants with tier-1 liquidity providers through a FOREX ECN Broker.

This linkage is done using sophisticated technology setup named FIX Protocol (Financial Information Exchange Protocol). At one end, the broker obtains liquidity from tier-1 liquidity providers (Major Banks) and makes it available for trading to its clients. On the other side, the broker delivers clients’ orders to Liquidity Providers for execution.

Broker benefits from commission fees per transaction. The higher trading volume the broker’s clients generate, the higher the broker’s profitability.

— OBOFX, https://obofx.com/what-is-ecn/

Samtrade FX

ECN is a type of computerized network that facilitates the trading of financial products outside traditional stock exchanges. It connects major brokerages and individual traders so they can trade directly between themselves without going through a middleman and make it possible for investors in different geographic locations to quickly and easily trade with each other.

— Samtrade FX, https://www.samtradefx.com/technology

Turnkeyforex.com

ECN is an Electronic Communication Network that links different participants of the Forex market: investment funds, banks, individual traders, etc. The ECN technology allows traders to specify the conditions at which they are ready to conclude the deal and the volume of the order is only limited by the market liquidity. This gives a trader the opportunity to easily execute large-volume orders. Due to advanced price aggregating technology, our clients can benefit from the tightest spreads, low commissions and best real-time price feed.

— Turnkeyforex.com, https://turnkeyforex.com/

Hextra Prime

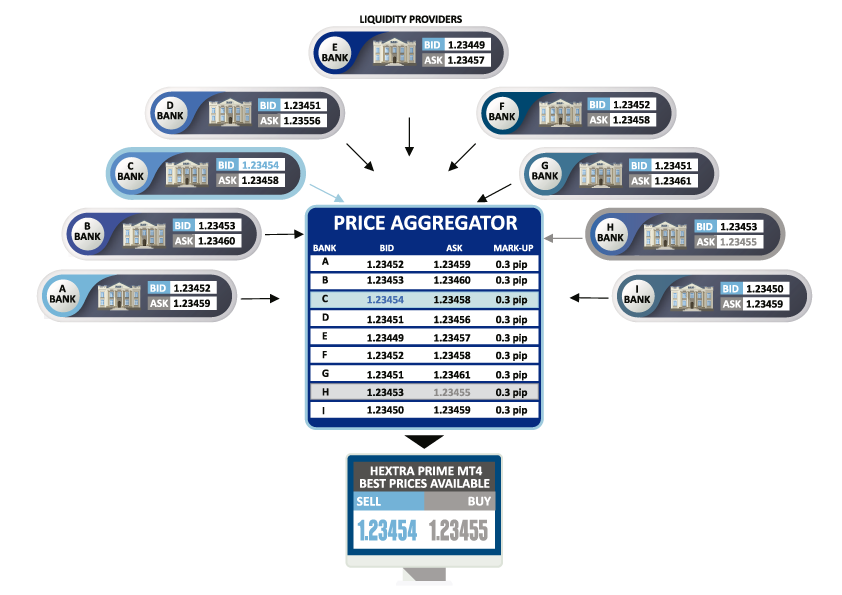

ECN stands for Electronic Communication Network and refers to an automated trading feature that links individual traders with the liquidity providers like banks, prime brokerages and retail brokerages, and even other traders. This mechanism allows individuals with every form of trading account access to the capital markets and regardless of their balance sizes. Linking all traders, big and small, with liquidity providers directly removes the need for a middleman in your transactions. ECN trading offers you narrower spreads and better market pricing. This is because the ECN broker consolidates quotes from several participants to offer you the tightest possible bid/ask spreads.

— Hextra Prime, https://hextraprime.com/ecn-technology/

Xglobalmarkets.com

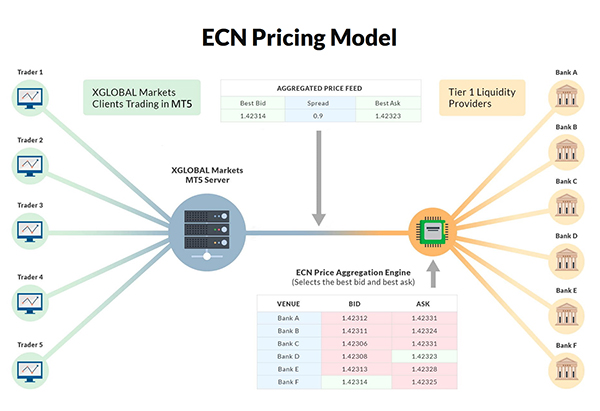

We stream a low latency ECN price feed that is ultimately sourced from the best bid and ask prices available at interbank market participants. Depending on account type we charge either volume based commissions or a competitive spread to the feed to ensure client positions can comfortably be covered with third party liquidity providers if we are not able to internally match them.

— Xglobalmarkets.com, https://www.xglobalmarkets.com/

XtreamForex

ECN is an electronic communication network that links different participants of the Forex market: investment funds, banks, individual forex traders, etc. To execute your order, the ECN technology searches through all orders placed by its participants in real time. Once it finds an opposite order with the matching price and enough volume, your order is executed. There are no intermediaries or dealers involved in the execution process.

— XtreamForex, https://xtreamforex.com/ecn-account/

⭐ How does DMA work?

IG.com

DMA displays the best bid and offer price available for a particular market, plus further prices on either side of the order book You place an order, and we instantaneously conduct a margin check to ensure you have sufficient funds to cover the margin on your proposed trade If the margin check is satisfied we place an order in the market and, at the same time, create a parallel CFD between you and us So while you’re trading at market prices, you won’t gain any ownership rights over the equities or currencies that form the subject of your CFD.

— IG.com, https://www.ig.com/en

Tier1FX

STP, DMA, ECN, none-dealing desk execution; concepts widely used across Forex industry, acronyms many time used to symbolize, being true or not, that the broker is "sending client’s trades directly to the market and not profiting client's losses".

Our promise to you: Trade in the real Market: We are an agency broker, we route each client trade to the best available liquidity provider without intervention. We offer none-marked up spreads to all our clients.

No conflict of Interests: Tier1FX will not profit of clients' losses in any circumstance, we don't take risk, we don't get losses shares from other brokers. We only trade with T1 banks and reputed financial institutions.

— Tier1FX, https://www.tier1fx.com/t1-brokerage/why-tier1fx/agency-model/

⭐ STP model

Immfx.com

STP stands for Straight-Through-Processing, which means when you place an order with IMMFX we will simply pass this trade to one of our liquidity providers. These liquidity providers are the largest banks in the world, have deeper liquidity and they are ultimate counter party to your trades.

As an STP brokerage firm we make a profit by marking up the spread. This means that the more trades you make the more money IMMFX makes, which creates a win-win situation for both IMMFX and its clients.

— immfx.com, https://immfx.com/

TrioMarkets

What is STP? STP is a name given when upon the receipt of a client order, it will pass the order directly to the liquidity provider. STP is a unique alternative which optimizes the speed of transactions by avoiding any interventions of a dealing desk.

Orders are automatically passed to our liquidity providers which then allows us to process trade orders in an efficient and timely manner that will meet the highest level of clients’ satisfaction.

An STP broker in effect will allow its clients to trade during the release times of financial news without any restrictions. No strategy restrictions, trade as you wish whenever you want to.

— TrioMarkets, https://www.triomarkets.eu/

Fair Forex

Not all brokers who state they are ECN are True ECN. Some brokers are actually STP (Straight through processing) brokers. This means that your trades go to different liquidity providers rather than to the whole network, meaning you don’t necessarily get the best available price on the market. Not only that but you are also more likely to experience higher slippage and delays. With Fair Forex True ECN we match your trade to the best price not to the available Liquidity provider.

— Fair Forex, https://help.fairforex.com/hc/en-us/articles/360043576571-What-does-TRUE-ECN-mean-

⭐ STP vs DD

Yadix

Dealing desks operate differently to an STP broker whereby the dealing desk will intercept clients’ orders from being passed through to the liquidity provider and take the opposite position, making profit on clients’ losses. This is the reason why, this broker type implements restrictions and limits on stop loss, take profit and pending orders. The logic is simple and restricts scalping and hedging traders the ability to make quick profits from fast order opening and closing and increase the chances of generating losses for the broker. At Yadix, as we do not trade against clients, it is in our interest for our clients to trade successfully and make profits without any trading restrictions. This we believe is the future of honest and transparent forex trading.

— Yadix, https://www.yadix.com/about-us/stp-forex-model/

VT Markets

Are there always Liquidity Providers (LP) involved in your trading model?

If a broker does not use LP’s to access the interbank market then they are a market maker and there is a direct conflict of interest between broker and trader. The account balances of all these different currency denominations are held within our segregated bank account. In our case this is with the National Australia Bank (NAB). These funds then allow the client to trade up to 50 currency pairs via our liquidity providers. Yes there is always possession and we serve on your behalf as agent (Wakeel) to take possession on your behalf. This is also known as A-Book broker model.

— VT Markets, https://www.vtmarkets.com/help-centre/

WSM International Broker

When trading on Forex, you can find different types of brokerage companies, where you can have your account. The significant difference between them is, regarding to the situation, that the brokerage company’s profits are based on client’s losses. The market maker or dealing desk Broker often has the level of spreads in 0 pips and it is important to remember that the profit of this kind of Broker may come from the side of the clients. In the case of trading through STP broker, the losses of the clients do not create income for the company but actually the spread is the only income of this Broker.

— WSM International Broker, https://www.wsmfx.com/about-us

⭐ STP vs NDD

Axes

Why Axes is not an STP Broker

STP (Straight-Through-Processing) is one of the most commonly misinterpreted terms in the trading industry. Although it is often considered to relate to the execution that a client receives from their broker, STP is in fact a post-execution, post-trade communication process between executing counterparties with minimal impact on the speed or price of execution that a retail trader is offered. Though Axes does use STP technologies, we classify ourselves as NDD in accordance to our method of order execution.

— Axes, https://axes.co/pricing/model/

⭐ ECN vs NDD

Axes

Why Axes is not an ECN Broker

ECN stands for Electronic Communication Network and is frequently confused with NDD execution. However, ECN refers to the anonymous communication between executing counterparties which may, in fact, result in no guaranteed fills and worse pricing for the retail trader. Axes is a true No Dealing Desk Execution broker, meaning that we execute client orders with no dealing desk intervention.

— Axes, https://axes.co/pricing/model/

Read next...

Add new comment...